Charitable Lead Trust

You fund a trust that makes gifts to us for a number of years. Your family receives the trust remainder at substantial tax savings.If you are looking for a way to pass on some of your assets to your family while reducing or eliminating gift or estate taxes, a charitable lead trust is an excellent option.

BENEFITS OF A CHARITABLE LEAD TRUST

- Receive a gift or estate tax charitable deduction

- Pass inheritance on to family at a reduced or zero cost

- Establish a vehicle from which you can make annual gifts to charity

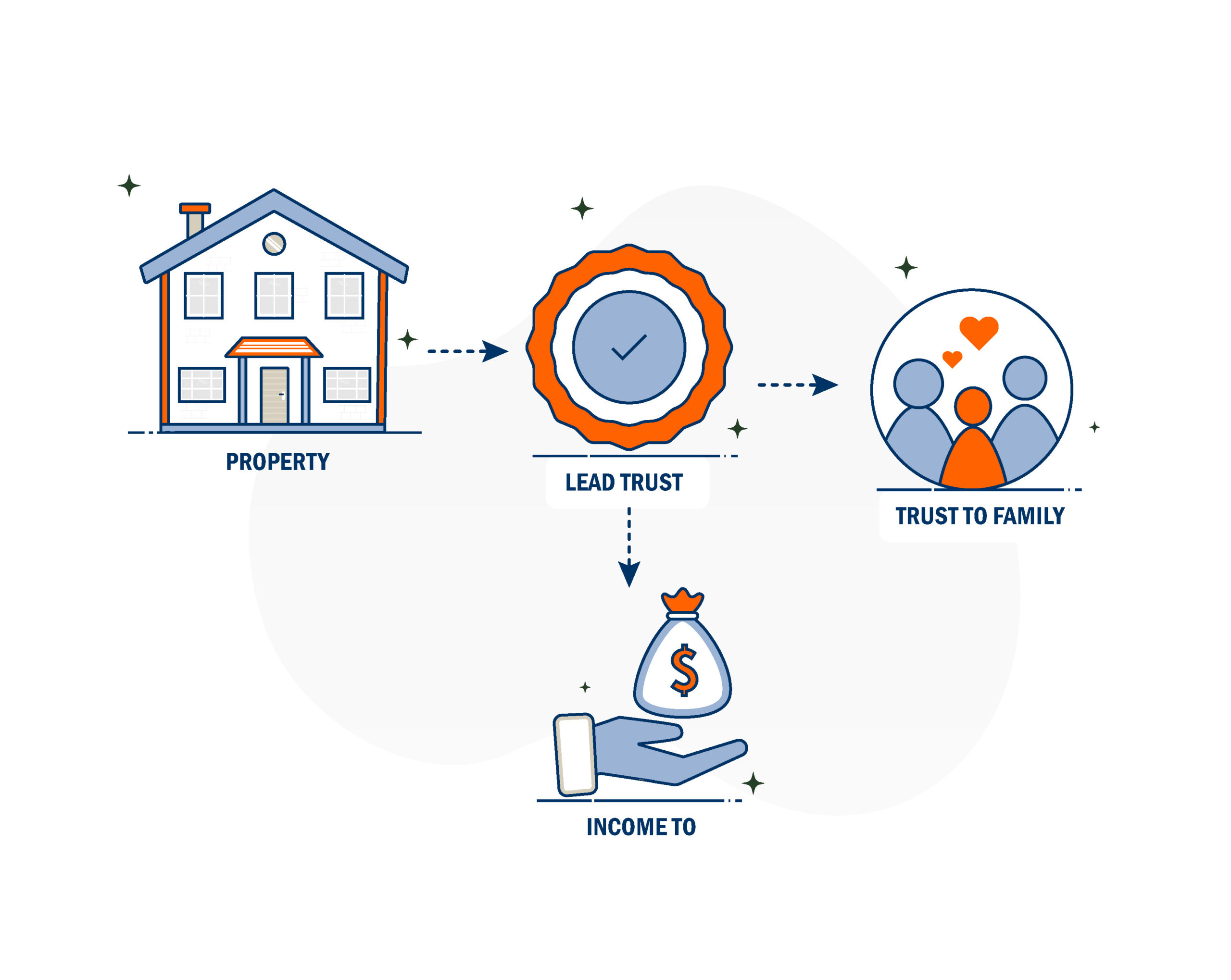

HOW A CHARITABLE LEAD TRUST WORKS

- You make a contribution of your property to fund a trust that pays Cascade Pacific Council, Boy Scouts of America income for a number of years.

- You receive a gift or estate tax deduction at the time of your gift.

- After a period of time, your family receives the trust assets plus any additional growth in value.

Key Contacts

Development Team: (503) 226-3423